How reform, resilience, and renewed confidence are driving the region’s economic revival.

While economic woes in the U.S., China and Europe have dominated the headlines and been the primary focus of world leaders and investors over the past year, few have noticed that the economies of Latin America are chugging along at a highly respectable rate that would be the envy of most any developed country.

Before we go any further, we would like to make a distinction between Emerging Markets and Latin American Markets – these terms are certainly not interchangeable. When we talk about Latin America markets, we make reference to the geographic collection of these. We define Latin America as being comprised of the markets (and economies) in countries found on the connected body of land that ranges all the way from Mexico to Argentina. Emerging Markets make no allowance for geographical representations but rather are defined according to what we believe are more arbitrary and variant definitions (such as relative size of the economy and degree of development). Therefore, to keep it simple we will be referring only to Latin America, not Emerging Markets (even though some Latin American markets are considered Emerging Markets).

In fact, the combined economies of the more than 16 countries that comprise the Latin American region (excluding the Caribbean), registered a decent 2.2 percent growth rate in real GDP in 2024, based on our estimates. Despite global economic issues slowing overall economic performance, Latin America is on track to register an average 2.6 percent growth in 2025, we believe.

In spite of this impressive trend, Latin America continues to battle the ill perception of – what we think of as - “the three ghosts” that have stereotyped the region for the last few decades. It’s time to slay those ghosts once and for all and give the region its due credit as the emerging economic power that it is.

Ghost 1: Political Instability & Weak Demographics

Stabilized by Reform and a Rising Middle Class

Forget the old banana republic stereotypes of the past. Those days are mostly over. Major democratic, social and institutional reforms throughout the region have led to the election of popularly elected leaders who have worked diligently to stabilize economic conditions and promote mostly pro-business measures. As the political climate throughout the region has stabilized, we’ve also seen significant growth in a new middle class, a middle class that is hungry for consumer products and foreign/regional travel. At least six Latin American countries today have a majority middle class population, and Brazil alone has added 20 million residents to its middle class in the last decade reaching more than half of its population (50.1%). Chile has a 65% of its population on the middle-class tier and the rest of the countries which we follow are close to 40%.

Rising education rates and increased income have empowered Latin American consumers to demand a fuller range of consumer goods, goods that are not only produced domestically but also purchased from regional markets (including the U.S.).

Two specific examples are mobile phones: Latin America is now one of the world’s most connected regions with more than 600 million cell phone subscribers with a 70% penetration rate among a population of 665 million; shopping abroad also had a

great effect, with Brazilians alone spending an estimated $6 billion

in the U.S.

Ghost 2: Ghost of Weak and Volatile Currencies

Banished by Fiscal Discipline

Weak Latin American currencies haunted most of the region in the 1980’s and 90’s. From Mexico to Argentina, the U.S. dollar, German deutschmark or British pound were the preferred referential forms of currencies. Savings were mainly in “other than” local currencies due to the possibility of losing purchasing power. Prices of goods, such as real estate, machinery and automobiles, carried dual price tags as well. Today we can look back at this period and perhaps understand it better as a time when Latin American economies were in a transitional period, setting the stage for attracting foreign direct investments. We believe this situation has turned around today thanks to the implementations of fiscal and monetary reforms. Controlling fiscal deficits, reducing external debt, structural reforms and pro-market policies and the strengthening of institutions like central banks.

The US dollar has been declining due, in part, to US policy uncertainty and tariff concerns. Plans for more aggressive fiscal stimulus abroad are energizing internation currencies, which appear to be building a position of strength.

Ghost 3: Ghost of High Inflation

Laid to Rest

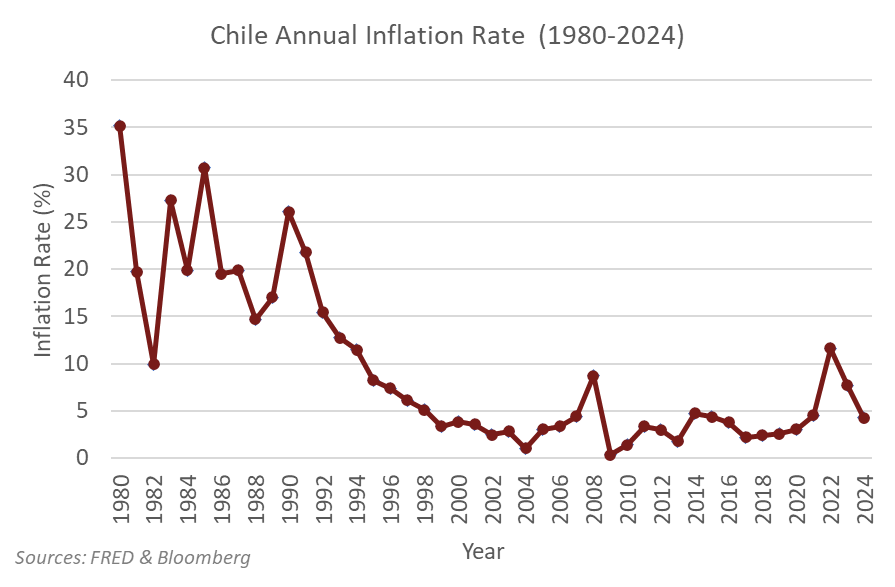

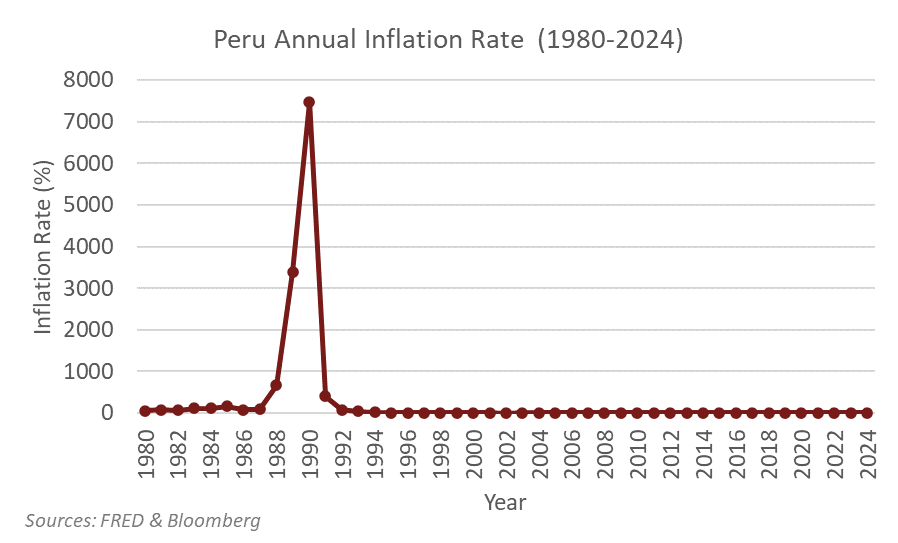

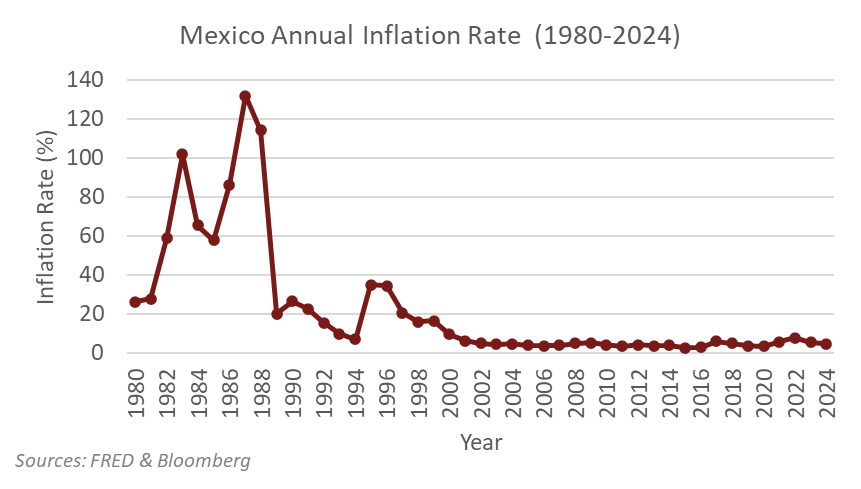

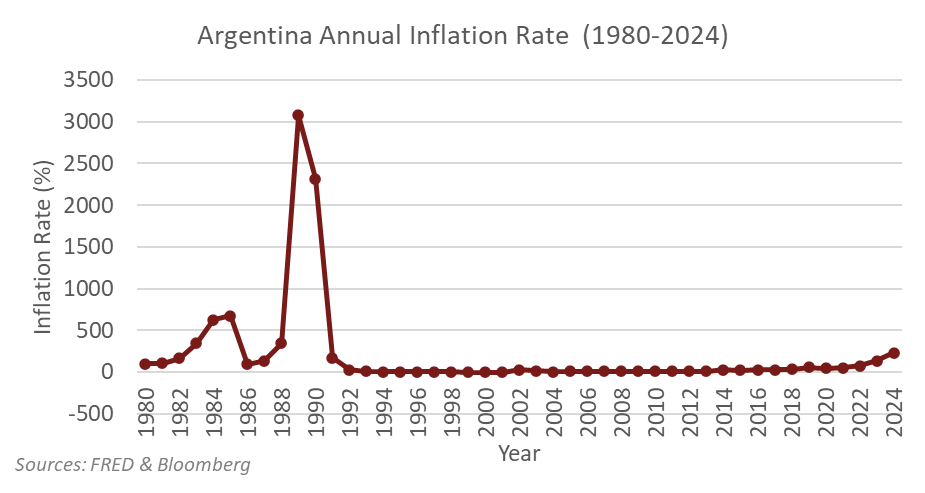

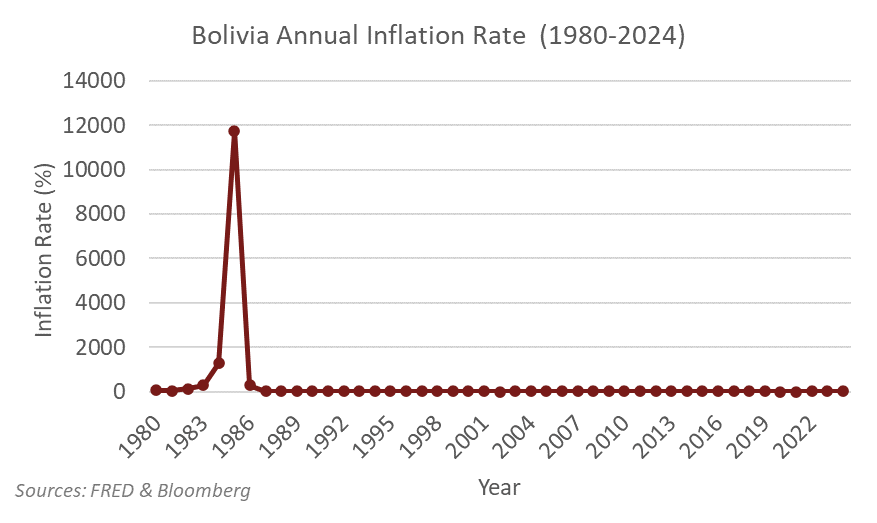

Probably one of the scariest of the three, low economic output, weakening currencies, outflow of international reserves, and a growing demand had the effect of driving up prices in the 1980’s and 90’s. Bolivia at one point had an inflation rate close to 25,000 percent! This situation has also turned around today, we believe.

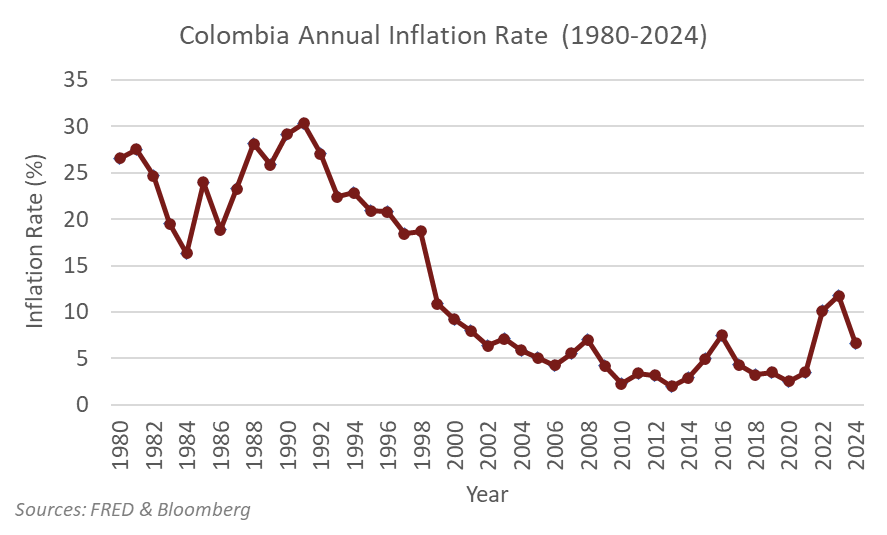

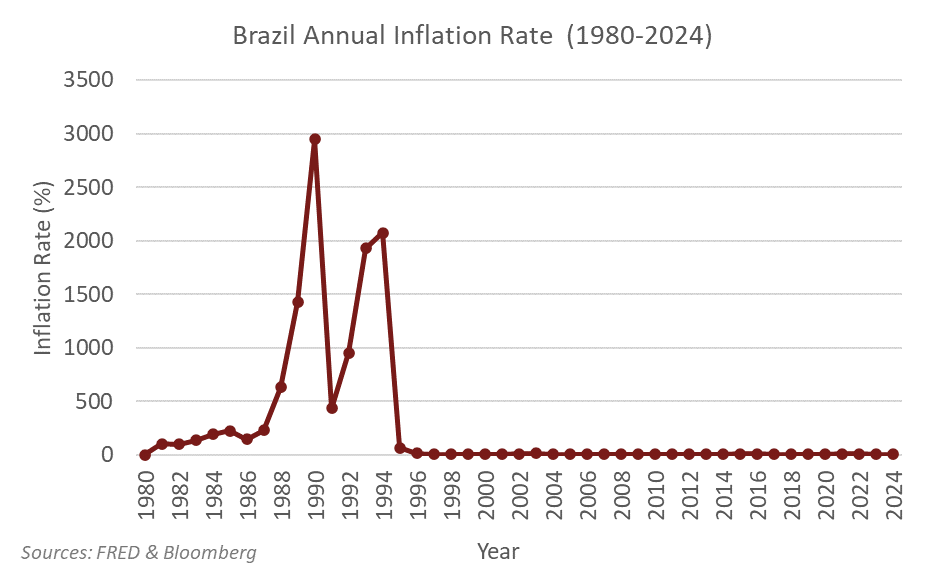

On the charts below we can see how these inflation rates changed over time:

As illustrated in the graphs, inflation levels across Latin America during 80`s and the first part of the 90`s were extraordinarily high. In some countries rates surged into the thousands of percent, reflecting periods of hyperinflation.

Over the years, these challenges have been successfully controlled. Today, most Latin American economies maintain single digit inflation rates with the exception of Argentina due to ongoing structural issues.

This is a great achievement for the region and shows successful implementation of monetary and fiscal reforms and institutional strengthening across finance ministries and central banks.

The Time is now

So, with these ghosts slowly fading, it is important to focus on the many positive attributes that make the case for Latin America now: an abundance of natural resources such as copper, oil, beef, lithium, soybeans and sugar; a new surge in the trade of goods and services within the region; and growth in tourism and manufacturing. We have to add a non-traditional sector in the region which is growing in big steps digitalization is the common theme that unites all countries as adaptation of technological platforms is changing the way consumers shop, bank and drive - a new chapter begins now!

Latin American nations are also turning increasingly to their neighbors on the Asian side of the Pacific for trade and investment opportunities. An economic commission from the United Nations reported that 25 percent of Latin America's exports went to Asian countries in 2024. Close to $480 billion goes to China making the second largest trading partner after the United States. Chinese investment in Latin America has jumped from a few million dollars just a few years

ago to about $180 billion nowadays, with most of the money going into mining and other extractive industries in Brazil, Peru

and other nations.

Despite the significant outperformance of Latin American markets year to date in 2025, valuations remain significantly discounted when compared to the United States. Historically, U.S. companies have delivered slightly better returns on capital, which helped justify their premium valuations.

Today the balance is shifting the trade-off between return on capital and valuations for emerging stocks is more attractive, this valuation gap could become a tailwind for emerging markets, with Latin America positioned to benefit meaningfully.

We believe Latin America is well poised economically, politically and socially to take center stage globally. In fact, the returns of these markets have already outperformed the most important US Indexes this year.

For investors seeking diversification and long-term growth, increasing allocations to international may be worth considering. And for those willing to look further south, Latin America offers a dynamic region that remains largely undiscovered by many global investors.

This opinion article was written on October 23, 2025, by the team of analysts at OTG Asset Management.

Disclosure: Foreign Investment Risk. Foreign investment risks include foreign security risk, foreign currency risk, and foreign sovereign risk. The prices of foreign securities may be more volatile than the prices of securities of U.S. issuers. In addition, changes in exchange rates and interest rates may adversely affect the values of the Fund’s foreign investments.

Latin America Risk. The Fund's performance is expected to be closely tied to social, political, and economic conditions within this region and may be more volatile than the performance of funds that invest in more developed countries and/or in more than one region.

Currency Risk. Currency conversion costs and currency fluctuations could erase investment gains or add to investment losses. Currency exchange rates can be volatile.